The Agreement also contains certain termination rights for both CNB and Akron,Īnd further provides that, upon termination of the Agreement upon specified circumstances, Akron may be required to pay CNB a termination fee of $2.5 million or CNB may be required to pay Akron a termination fee of $1.25 million. The Agreement contains customary representations and warranties of the parties. Elections will be subject to proration procedures whereby at least 75% of Akron shares will be exchanged for CNB common stock. The Agreement provides that shareholders of Akron will have the right to elect to receive, for each share of AkronĬommon stock, either (x) $215.00 in cash or (y) 6.6729 shares of CNB common stock (the ∾xchange Ratio). Following the completion of the Merger, Akron will operate as part of Under the terms of the Agreement, which has beenĪpproved by the boards of directors of each party thereto, Akron will be merged with and into CNB Bank (the Merger) with CNB Bank continuing as the surviving entity. On December 18, 2019, CNB Financial Corporation (∼NB), CNB Bank (∼NB Bank) and Bank of Akron (∺kron) entered into anĪgreement and Plan of Merger (the ∺greement), pursuant to which CNB will acquire Akron. Growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of theĮntry into a Material Definitive Agreement. Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Name of each exchange on which registered Securities registered pursuant to Section 12(b) of the Act: ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Soliciting material pursuant to Rule 14a-12 under the Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) If the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: Registrants telephone number, including area code: (814) 765-9621

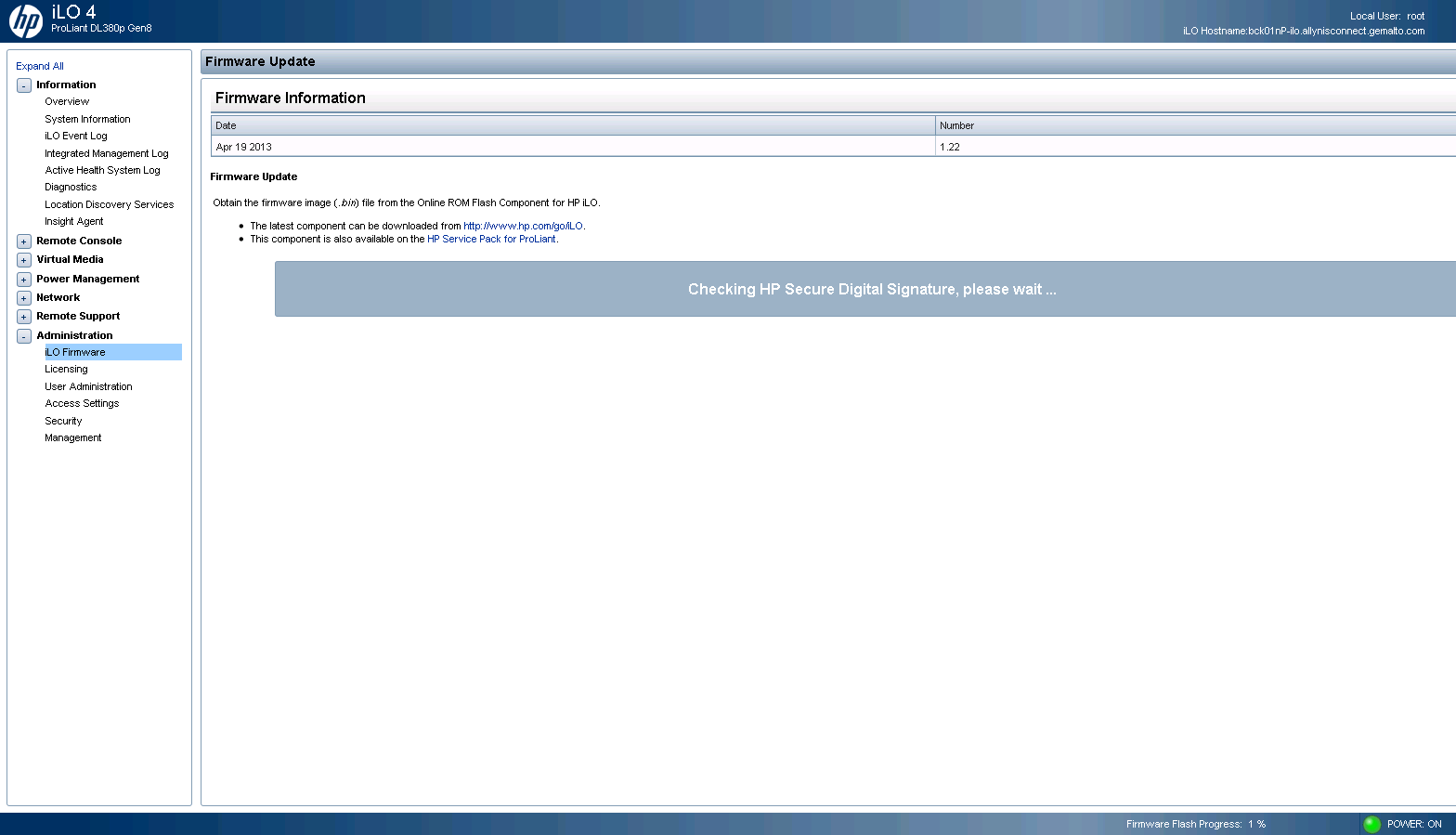

CHECK SELF SIGNED CERTIFICATE HP ILO 4 2.55 ZIP

(Address of principal executive offices, zip code) (Exact name of registrant as specified in its charter)

Date of report (Date of earliest event reported): December 18, 2019

0 kommentar(er)

0 kommentar(er)